T2033 Transfer Form

Learn How to Complete a T2033 Transfer Form

Download The T2033

Download pdf file: ![]() T2033

T2033

9 Step Process

Learn how to fill in a T2033 transfer form in 9 simple steps outlined below.

Step 1. Download a Copy of a T2033

The goverment of Canada's T2033 Transfer form can be downloaded from their website. Download the T2033 Transfer Form

Step 2. Print the 5 pages of the T2033

A T2033 transfer form has 5 pages in total. However 4 pages are just extra copies that need to be completed for the parties involved and the last page is an instructions page.

Page 1 Copy 1 – For the transferor

Page 2. Copy 2 – For the annuitant

Page 3. Copy 3 – For the transferee

Page 4. Copy 4 – For the transferor

Page 5. Instructions

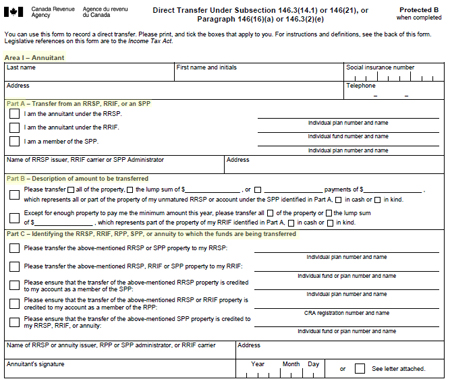

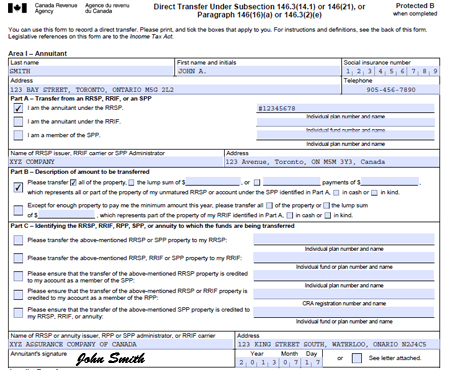

Step 3. Complete Page 1, Area 1 by the Annuitant

The folowing section are to be complted by the annuitant (you).

The annuitant asking for the transfer completes and signs Area I. Four copies of the form have to be given to the RRSP issuer, RRIF carrier, SPP or RPP

administrator to which the property is to be transferred (the transferee). In place of a signature, the transferee who completes Area I for the annuitant can

attach a copy of a signed letter from the annuitant asking for the direct transfer.

Part A - Transfer from an RRSP, RRIF, or an SPP

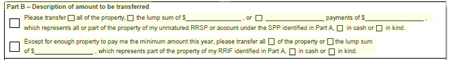

Part B - Description of amount to be transferred

Part C - Identifying the RRSP, RRIF, RPP, SPP, or annuity to which the funds are being transferred

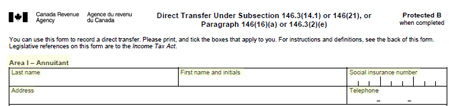

Step 4. Complete, Area 1 - Annuitant

Complete the following details:

- Last name

- First name and initials

- Social insurance number

- Address

- Telephone

Click to enlarge image: T2033 Area 1 - Annuitant

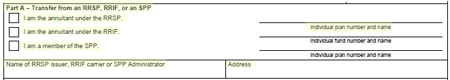

Step 5. Complete Part A

Part A - Transfer from an RRSP, RRIF, or an SPP

1. Check one of the boxes

I am the annuitant under the RRSP.

I am the annuitant under the RRIF.

I am a member of the SPP.

2. Type in your Individual plan number and name

3. Type in Name of RRSP issuer, RRIF carrier or SPP Administrator

4. Type in Address of RRSP issuer, RRIF carrier or SPP Administrator

Click to enlarge image: T2033 Part A

Step 6. Complete Part B

Part B - Description of amount to be transferred.

1. Check one of the boxes and complete the amount to be transferred if necessary.

Please transfer all of the property, the lump sum of $________________ , or _________________ payments of $_________________ ,

which represents all or part of the property of my unmatured RRSP or account under the SPP identified in Part A, in cash or in kind.Except for enough property to pay me the minimum amount this year, please transfer all of the property or the lump sum

of $_________________ , which represents part of the property of my RRIF identified in Part A, in cash or in kind.

Click to enlarge image: T2033 Part B

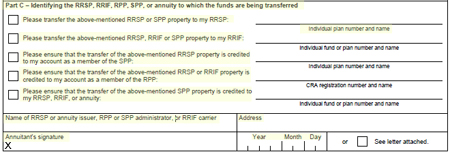

Step 7. Sign and Date Part C

Part C - Identifying the RRSP, RRIF, RPP, SPP, or annuity to which the funds are being transferred.

This part of the T2033 should be left blank. The following information will be completed when the Individual plan number and name become available by the broker or agent.

Annuitant is required to sign and date this part of the T2033.

1. Broker/Agent checks one of the boxes

Please transfer the above-mentioned RRSP or SPP property to my RRSP:

Please transfer the above-mentioned RRSP, RRIF or SPP property to my RRIF:

Please ensure that the transfer of the above-mentioned RRSP property is credited to my account as a member of the SPP:

Please ensure that the transfer of the above-mentioned RRSP or RRIF property is credited to my account as a member of the RPP:

Please ensure that the transfer of the above-mentioned SPP property is credited to my RRSP, RRIF, or annuity:

2. Complete the Individual plan number and name.

3. Name of RRSP or annuity issuer, RPP or SPP administrator, or RRIF carrier

4. Address of RRSP or annuity issuer, RPP or SPP administrator, or RRIF carrier

5. Annuitant's signature (your signature)

6. Date

Click to enlarge image: T2033 Part C

Step 8. Do Not Complete Areas II, III, & IV

Area II – Transferee

The transferee completes and signs Area II. The transferee sends all copies to the RRSP issuer, RRIF carrier or SPP administrator from which the property

is to be transferred (the transferor).

Area III – Transferor

The transferor completes and signs Area III. The transferor keeps one copy, and sends the remaining three copies to the transferee, along with the property

being transferred.

Area IV – Receipt by transferee

The transferee completes and signs Area IV of all copies. The transferee keeps one copy, returns one to the transferor, and gives the last one to the

annuitant.

These areas are to be completed by the insurance/financial institutions.

Step 9. Repeat Steps 4 to 7

Make sure to copy the same details from Steps 1 to 4 for the remaining 3 pages.

Click to enlarge image: Completed T2033 Form

T2033 Definitions and Acronyms

- Acronyms – the following is a list of the acronyms we use:

- RPP – registered pension plan

- RRIF – registered retirement income fund

- RRSP - registered retirement savings plan

- SPP – specified pension plan (currently the Saskatchewan pension plan is the only arrangement prescribed under the Income tax regulations to be a specified pension plan.)

- Annuitant – the person who is entitled to receive payments from an RRSP or a RRIF.

- Individual plan number or individual fund number – the individual account, contract, certificate, or other identifier number that the RRSP issuer or RRIF carrier assigns.

- Member – the person who is entitled to receive payments from an RPP or a SPP.

- Qualifying RRIF – a RRIF established before 1993, that has no property transferred or contributed to it after 1992, or any RRIF established after 1992, that contains only property transferred from a qualifying RRIF.

- RPP administrator – the person or organization that is responsible for administering the RPP.

- RRIF carrier – a person described in subsection 146.3(1), with whom an annuitant has an arrangement that is a RRIF.

- RRSP issuer– a person described in subsection 146(1), with whom an annuitant has a contract or arrangement that is an RRSP.

- SPP administrator – the person or organization that is responsible for administering the SPP.